Is Reshoring Manufacturing Back to the U.S. the Next Industrial Revolution?

Posted on 4/24/23 2:17 PM

For those working directly with supply chains, the memories of lockdowns and ongoing supply chain disruptions are likely indelible. Newton’s Third Law of Motion states, “For every action, there is an equal and opposite reaction.” The “reaction” is still knocking around the Supply Chain enough to give purchasers, shippers, and receivers a mild case of PTSD.

Reshoring Enlightenment

In a previous Connections we took a dive into U.S.-China relations citing expert Emily de La Bruyere, a senior fellow at the Foundation for Defense of Democracies (FDD), and founder of Horizon Advisory. Her analysis was a stark reminder of how dependent the U.S. and other Western nations have become on Chinese goods for nearly four decades.

Specifically, what would decoupling from China look like? How would the reshoring of America’s manufacturing sector take place? De La Bruyere predicted a slower rather than a faster reshoring, but that prediction preceded the Chinese spy balloon on a flight path over U.S. military installations in broad daylight for American citizens to see.

The aggression of such an act, combined with ever-increasing threats to Taiwan, may have swerved decoupling into the fast lane. Reshoring manufacturing plants back to the U.S. has been discussed for decades, but generally its level of alacrity rose to that of a stifled yawn—complexities, especially for larger companies, which must have rivaled that of retrieving the Mars rover.

Historical Snapshot

In the 1990s, America couldn’t sell enough grain or build enough assembly plants and factories in China; it couldn’t wait to fill plants and factories with cheap labor. Never mind that the Chinese government was literally caught red-handed stealing U.S. industrial and defense secrets (semiconductors to fighter jet technology), or that by the late 1990s, the U.S. Administration gifted China with supercomputers giving them a fast-track to nuclear warhead delivery systems. And there’s the Chinese version of the hammer-and-sickle specter looming over how much business control American companies actually have in China, and how much is under the control of the Chinese Communist Party.

China’s manipulation of industry hardly ends there. More recently we have the vanadium redox battery conundrum, a battery invented in a U.S. government lab in the state of Washington. This perfect mix of acid and electrolytes in refrigerator-sized batteries could power a house for decades—they can charge and recharge for up to 30 years. These batteries were created in a U.S. government lab, a lab where every rivet, screw, and computer was paid for by American tax dollars.

Apparently, domestic dystopian corruption knows no bounds—China is now manufacturing this American battery—the U.S. has yet to manufacture its own invention because its government is holding the inventors up. One can only thank the U.S. Department of Energy for the transfer of “power”—it signed off on having China manufacture them instead.

Thankfully, many state legislators have yet to go rogue; many private companies have, are, or will be reshoring manufacturing back to the States to control their own destinies.

Reshoring By the Numbers

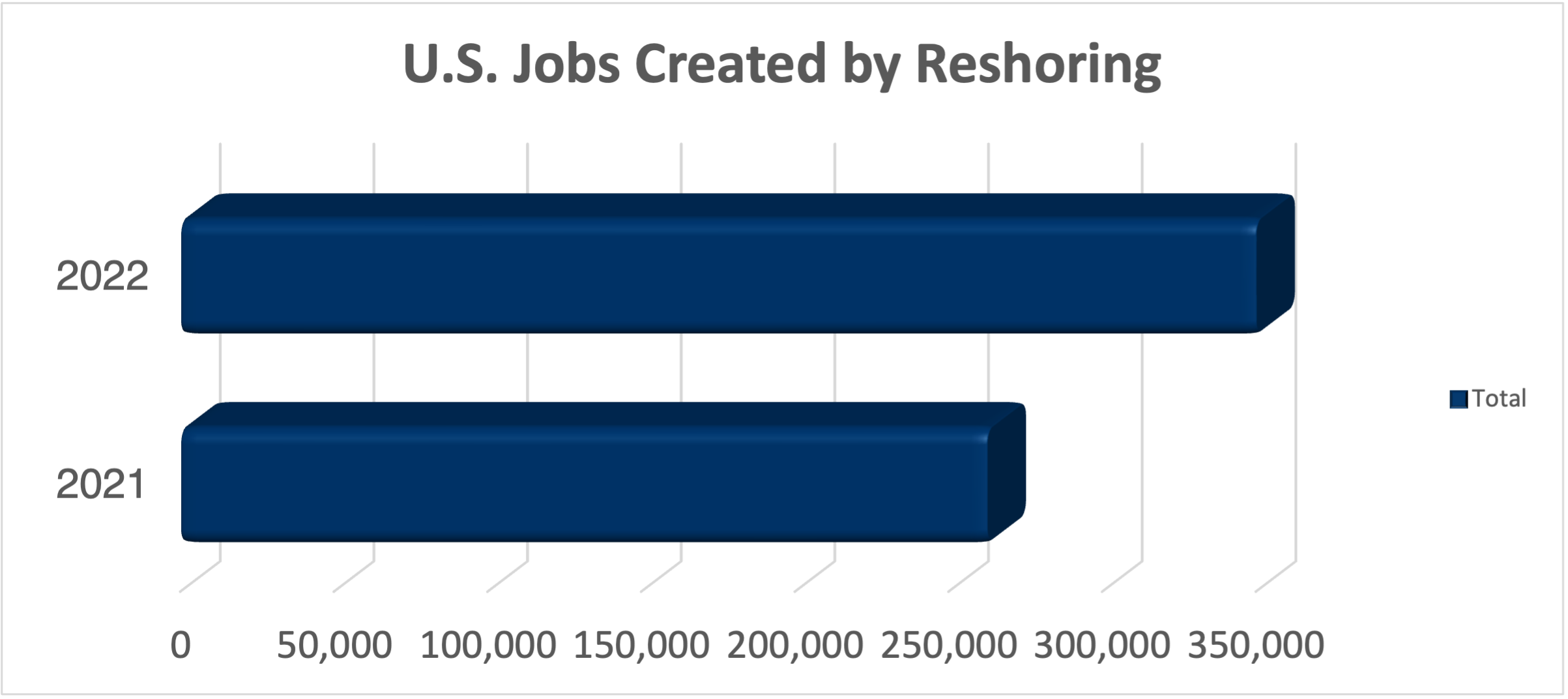

Fast-forward to 2023. According to Deloitte, 62% of 305 U.S. transport and manufacturing executives have confirmed their companies have begun to reshore or near-shore to the U.S. Nearly 350,000 jobs were created due to reshoring efforts in 2022, a 25% increase from 2021. From the Deloitte survey, the trend for 2023 looks even more promising for reshoring. The survey sums it neatly up:

[These industrial and political reasons] . . . are combining to create conditions for this movement to finally have legs,

Deloitte wrote in its report.

Mike McGaugh, the CEO of Myers Industries Inc., of Akron, Ohio, (plastics and rubber) indicated to Bloomberg that reshoring is a reality and not merely a blip on the radar. McGaugh on the supply chain movement:

Supply chain issues spooked customers in the last two or three years. Even if the costs are higher on labor, the ability to have rapid feedback and rapid delivery means something to our customers.

Commercial Metals CEO Barbara Smith of Irving, Texas, agrees. “Pandemic and geopolitical events have reminded us of the need for a more distributed set of sourcing options, ensuring reliability and flexibility in securing critical materials and equipment,” she said.

In 2023, it is estimated that 1,800 companies in the U.S. plan to reshore production to the states. According to figures cited in Deloitte’s ‘Future of Freight’ report, the reshoring shift could reduce the share of Asian imports to the U.S. by 40% by 2030.

Interpower is one of two remaining electrical cord manufacturers in America. Interpower is a premier supplier of power cords, cord sets, and components worldwide, making it easier for customers to design, build, and maintain products for global markets.

Topics: USA Made Products, shipping, Global Markets